New companies step in to help solar contractors secure IRA’s many tax benefits

This article originally published on Solar Power World

By Billy Ludt | November 4, 2023

Services and software are materializing to guide the solar industry through the learning curve of the Inflation Reduction Act (IRA) and its clean energy provisions.

The IRA was devised as an aid to the U.S. solar industry, with provisions containing tax credits available to installers, manufacturers and system owners. The legislation has been enacted for a little more than a year, but many questions remain about how to comply with the various new credit requirements.

Policy-savvy entrepreneurs are building businesses focused on helping eligible companies and system owners receive those new government benefits and transfer the tax credits to other entities if they choose.

Helping the solar industry qualify for IRA credits

Prior to the IRA, individuals or businesses had to file a form with the IRS to claim the solar ITC on a project. The enhanced tax benefits included in the IRA can work in conjunction with the ITC and require verifying and filing new sets of information.

With whole new compliance requirements to consider and significant subsidies on the line, outside companies have emerged to handle that process for solar contractors. One new service in that space is Empact Technologies.

Empact was adapted from founder Charles Dauber’s previous business, Warm Commerce, which helps industrial companies manage their supply chains. He recognized the two most important factors in qualifying for IRA tax credits were verifying the origin of hardware used in projects and meeting labor requirements, which were services Warm Commerce already offered.

Empact was adapted from founder Charles Dauber’s previous business, Warm Commerce, which helps industrial companies manage their supply chains. He recognized the two most important factors in qualifying for IRA tax credits were verifying the origin of hardware used in projects and meeting labor requirements, which were services Warm Commerce already offered.

Empact now works with utility and community-scale solar developers to establish what tax credits to pursue on a project and ensure compliance. The base credit could be the ITC, which requires contractors to pay a prevailing wage for that region and employ a certain number of apprentices during construction for the full credit. Empact uses payroll data from the developer’s EPC to verify that those wage and employment conditions are met.

With the ITC as a foundation, developers can branch out to other tax credits from there. The next could be domestic content, a 10% bonus credit for projects that use American-made components, like racking with 100% U.S. steel. Then depending on the project’s location, it could be eligible for incentives for building in low-income or energy communities.

“EPCs are going to have to figure out how to go and deliver this compliance if they want to work on these projects. The suppliers are going to have to figure out how to provide the data so they can meet these domestic content requirements,” Dauber said. “And then the developers and their investors have to figure out how to work with somebody like us to put all this together to make sure they can actually take advantage of these tax incentives.”

At its core, Empact is a data management company. The company ensures projects don’t have non-compliance issues to reduce the risk of forfeiting tax credits. If something is filed incorrectly with the IRS on a large-scale solar project, developers could lose tens of millions of dollars.

“For tax incentives that are worth 30% or 40% of the entire value of the project, it’s our view that the industry could use something that is very professionally managed and goes through the entire process,” Dauber said. “The default right now would be people just trying to use whatever tools they happen to have in their offices.”

Transferring clean energy credits

The IRA has also given clean energy tax credit recipients the option to transfer or sell those credits to other parties. But the transaction isn’t as simple as a cash exchange. The tax credit isn’t a product on a shelf — it’s equity that can apply to a business or individual’s annual tax liability. That means there’s more documents involved and oversight from the IRS during the transaction.

Then, there’s the question of finding someone willing to buy a tax credit. Companies facilitating these transactions are hoping to make that experience simpler through online marketplaces.

“If it happens offline, then it makes it very hard for a buyer and seller to actually meet each other. You’re going to have to rely on either intermediaries or brokers, and that relies on their personal networks,” said Leng Lee, co-founder of tax credit marketplace Atheva. “Therefore, if you’re a seller, the chances of finding the best buyer for your credit and getting the best price is lower, or the fee that you have to pay that particular intermediary is a lot higher.”

Lee said Atheva can be described as the “eBay of tax credits,” because it functions similarly to the popular auction website. People who have registered tax credits with the IRS can sign up and list them from solar and other clean energy projects. The listing includes any documents relevant to the credits. Interested buyers can bid on or outright purchase a credit and then file it with their annual taxes once it’s in their possession.

Another feature of transferability is that tax credits do not need to be purchased in full; percentages of tax credits can be bought. But it’s important to note these credits aren’t received as cash — they can only be applied to lower a company’s annual tax bill.

“You’re buying a way to pay off your tax bill. This tax credit can’t be used for anything else, so it’s not money,” Lee said. “It can only be used to reduce your taxes.”

The value of tax credits for the seller varies, but transactions have been valued at 80¢ per dollar and higher on Basis Climate, another marketplace for transferable IRA credits, according to co-founder and chief product officer Derek Silverman. For sellers with low tax bills, this extra cash is much more useful than extra tax credits they may or may not be able to apply to their tax filings.

“We know there are sales that don’t get closed by installers because when they start talking about the financial structure and say, ‘You’re going to qualify for this tax credit,’ [the project owner] might not have an appetite for tax credits this year,” Silverman said. “They’re like, ‘OK, then we can sell them, and we get you cash when it’s placed in service, which you could apply to the [project] loan.”

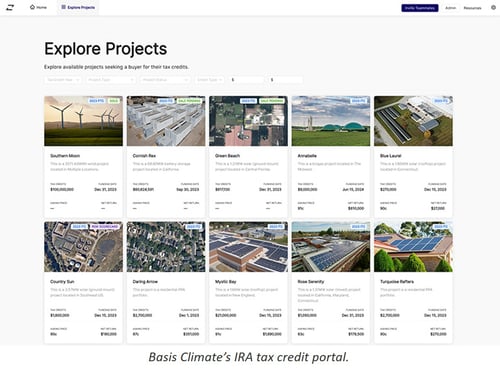

Basis Climate is also giving credit holders the tools to list their tax credits for sale and works with buyers to determine their tax load and connect them to the appropriate credits. Basis Climate lists information on each project, like the development company’s history, the project’s address and photos of the system itself, to give buyers confidence that the credits are legitimate.

Basis Climate is also giving credit holders the tools to list their tax credits for sale and works with buyers to determine their tax load and connect them to the appropriate credits. Basis Climate lists information on each project, like the development company’s history, the project’s address and photos of the system itself, to give buyers confidence that the credits are legitimate.

“We think that there is value in having a central player creating a navigable path,” said Erik Underwood, co-founder and CEO of Basis Climate. “More than anything, it’s the fact that we think that somebody needs to put in effort on, ‘How do you focus on getting this done efficiently at the small transactional level?’ Otherwise, you’re going to be stuck in the tax equity world with expensive accountants, lawyers and really long, painful deal processes.”

Atheva and Basis Climate do both take a percentage of each transaction, but believe the cost is reasonable, and more convenient, compared to alternative services.

There will undoubtedly be more questions about qualifying for tax credits, but despite the intricacies of its legislative language, the IRA is already fueling unprecedented installation growth in the U.S. solar industry.

“It’s massive — it’s as big of a game changer you could ever imagine as an industry,” Empact’s Dauber said. “Every single person that’s reading your publication will be impacted by this in some way, shape or form. It’s everywhere.”

ABOUT THE AUTHOR

Billy Ludt

Billy Ludt is senior editor of Solar Power World and currently covers topics on mounting, installation and business issues.